Today’s electricity markets no longer reflect the real costs of building and operating today’s mix of generating capacity. What’s worse is that they have the potential to frustrate the net-zero transition.

In the UK, in common with many power markets in the industrial world, electricity prices follow the price of natural gas. As we are seeing in the current energy crisis, this is saddling consumers with sky-high bills. It is also generating windfall profits for existing renewable energy operators and nuclear plants.

This is leading many – including policymakers and regulators – to question the structure of wholesale energy markets, and to call for their reform. Power markets in the UK and other countries need to be overhauled if we are to successfully decarbonise our electricity supply. First, however, it is important to understand how they currently work.

Pricing at the margin

Electricity is hard to store; supply and demand need to be physically balanced at all times. This can be done (well) by a centralised administrative system but, in common with many other markets around the world, power price formation in the UK market is based on marginal pricing. Each generator is required to bid in the price it will accept to generate power for each 30-minute interval (in some other markets, this time band is different) throughout the day.

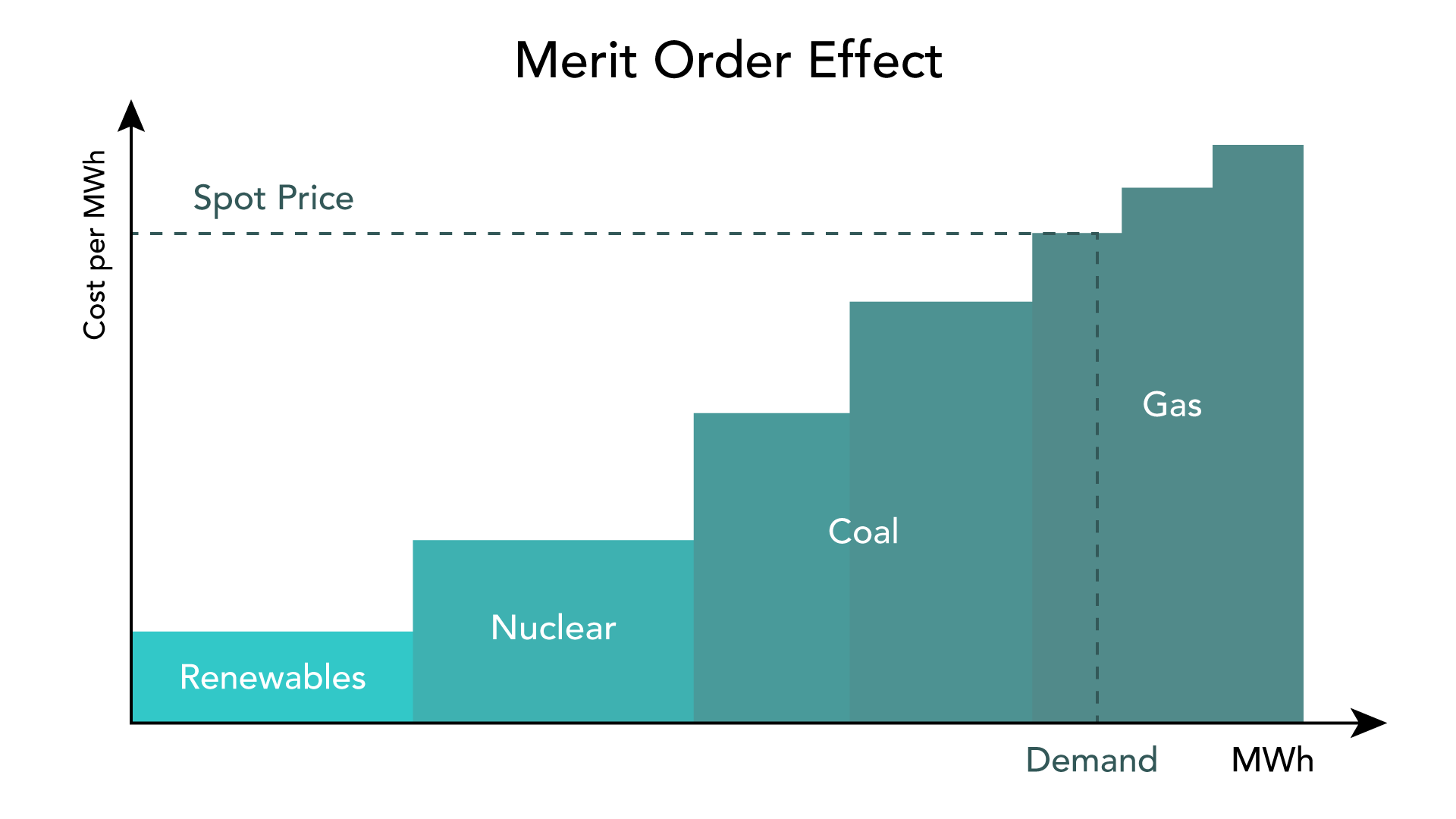

These bids are based on the operating costs that each generator faces, taking into account the costs of starting up or shutting down generation. Wind and solar plants tend to have the lowest operating costs, followed by nuclear power plants, while natural gas-fired plants typically have the highest operating costs – and certainly do so given current gas prices.

The prices bid in by the various generators form what is known as the merit order. This is a theoretical stack of generating capacity, from cheapest to most expensive, that is available to supply power during each 30-minute increment.

In the UK, National Grid, the electricity system operator, will then contract with enough generators to ensure that there is sufficient supply to balance expected demand.

The price bid by the marginal generator – the most expensive plant needed to supply power to balance the market – becomes the clearing price, which all generators are paid.

Most generators, then, will earn more than their operating costs. The difference between their costs and the clearing price is what will enable them to recover their capital expenditure and earn a profit. This will, over time, encourage additional investment in generating capacity.

Because very little demand is responsive to prices in the short-term, the market is typically balanced on the supply side. However, there are peaks in demand throughout the day, and seasonal fluctuations. This means that the marginal supply needed to meet these peaks in demand is only used a few times a year, and thus needs to be very expensive to capture enough revenue to be profitable.

A fossilised system

This system, or a variant of it, has operated in the UK since electricity markets were liberalised in the early 1990s. Then, the generating fleet comprised a relatively small number of large thermal power plants, mostly burning coal or powered by nuclear reactors.

Then, the low operating costs of nuclear plants put them at the top of the merit order, followed by coal and then natural gas. At periods of high demand, the most expensive capacity – gas-fired ‘peaking’ plants – could be quickly ramped up to balance the market, setting the marginal price.

Since the turn of the century, large numbers of relatively small renewable energy plants have been added to the UK’s generating mix. They are mostly wind or solar plants. Given they do not need to pay for their fuel, their operating costs are very low – perhaps 10-20% of their overall costs, compared with 30% for coal and more than 50% for baseload natural gas plants.

Competitive green power

For wind and solar plants, most of their costs are incurred upfront, in raising the capital to buy and install the generating equipment. Because renewables are so capital intensive, the returns are driven primarily by wholesale prices, unlike fossil fuel generation where returns are driven by the spread between fuel costs and power prices. Until recently, power prices have been below levels sufficient to cover the capex and opex of renewables and, as a result they have needed subsidies to get built; for example, the UK government has run several auctions for contracts-for-difference for offshore wind and solar plants, which guarantee a minimum price for the power generated.

Now, however, renewable energy is becoming increasingly competitive, and growing volumes are being built without subsidy. Some are entering into long-term power purchase agreements with utilities or corporate buyers, or are operating on a ‘merchant’ basis, selling directly into the wholesale market, earning whatever the power price is at that particular time.

However, while wind and solar power costs have fallen relative to fossil fuel generation, the power they generate remains intermittent. Solar is only available during daylight hours, and periods of low wind can leave windfarms becalmed.

Unintended consequences

As the volumes of renewable energy within the merit order rise, the functioning of a wholesale power market based on marginal pricing begins to break down.

The first problem stems from the intermittency of renewables caused by weather patterns. On average, systems with lots of renewables will push the merit order curve either to the left or to the right, potentially leading to very low or very high clearing prices. The sudden temporary disappearance of large volumes of renewables capacity from the merit order – during a period of low wind, for example – would force the marginal price to rise very high to meet demand.

This means the system needs increasing amounts of flexible generation as we shift to more renewables on standby to meet this demand. This risk could be even greater if market participants bid their capacity at prices higher than the marginal cost, knowing those bids needed to be accepted to cover the supply shortfall.

The second problem is known as cannibalisation. As the base of the merit order fills up with low-cost renewables with the same generation profile, they face growing ‘capture’ risk. Put simply, because all wind farms generate power when the wind blows, this forces prices down. Conversely, when there is no wind, power prices rise, but wind farms are unable to benefit. This means they capture a declining proportion of average power prices over a given period, making it harder for renewable plants to recoup their capital expenditure. The more renewables that come on to the system, the worse this problem becomes – hence the term cannibalisation. As a stark example of this, during December of last year the monthly capture factor (capture factor = capture price/baseload price) for UK wind under the CFD collapsed to 81.4%; the capture price was £221.09 versus the baseload price of £259.26.

The third problem is the perception that, during the period of high prices that we are currently in, these low-cost generators are seen by the public and policymakers to be earning excess profits. Because the clearing price is set by gas-fired generators, and because gas is currently so expensive, this has led to calls for renewable energy operators to face a cap on revenues or windfall taxes on these profits.

New approaches to electricity markets

Despite these drawbacks, marginal pricing currently sets the wholesale power price, and this price (averaged over months and years) has tended to drive the prices at which aggregators, electricity suppliers and corporates are willing to buy power in the market. But, as we shall see in the next article, there are alternative ways of pricing power from new-to-earth renewable generators which, we argue, could make more sense for sellers and buyers alike.